How Home Equity Loan Can Finance Your Following Big Task

How Home Equity Loan Can Finance Your Following Big Task

Blog Article

The Leading Reasons That House Owners Pick to Protect an Equity Financing

For numerous home owners, choosing to safeguard an equity finance is a critical monetary decision that can offer numerous advantages. The ability to use the equity constructed in one's home can provide a lifeline during times of monetary demand or serve as a device to achieve particular goals. From combining debt to taking on significant home renovations, the reasons driving individuals to go with an equity funding are impactful and varied. Understanding these motivations can clarify the prudent economic preparation that underpins such selections.

Financial Obligation Consolidation

Homeowners frequently go with safeguarding an equity loan as a critical economic step for financial debt consolidation. By leveraging the equity in their homes, individuals can access a lump amount of money at a reduced rate of interest contrasted to other forms of loaning. This capital can after that be made use of to settle high-interest debts, such as credit rating card balances or individual finances, enabling house owners to improve their monetary responsibilities right into a single, more convenient month-to-month repayment.

Debt combination via an equity finance can supply a number of advantages to homeowners. To start with, it streamlines the repayment procedure by integrating numerous debts into one, lowering the threat of missed out on payments and possible fines. The lower rate of interest price linked with equity loans can result in substantial cost financial savings over time. Furthermore, combining financial debt in this manner can boost an individual's credit report score by reducing their general debt-to-income proportion.

Home Enhancement Projects

Thinking about the improved worth and capability that can be achieved with leveraging equity, several people choose to designate funds in the direction of different home improvement projects - Alpine Credits Home Equity Loans. Property owners usually choose to secure an equity car loan particularly for restoring their homes due to the substantial returns on financial investment that such tasks can bring. Whether it's updating out-of-date features, increasing home, or improving power performance, home renovations can not just make living areas much more comfy yet additionally boost the overall worth of the home

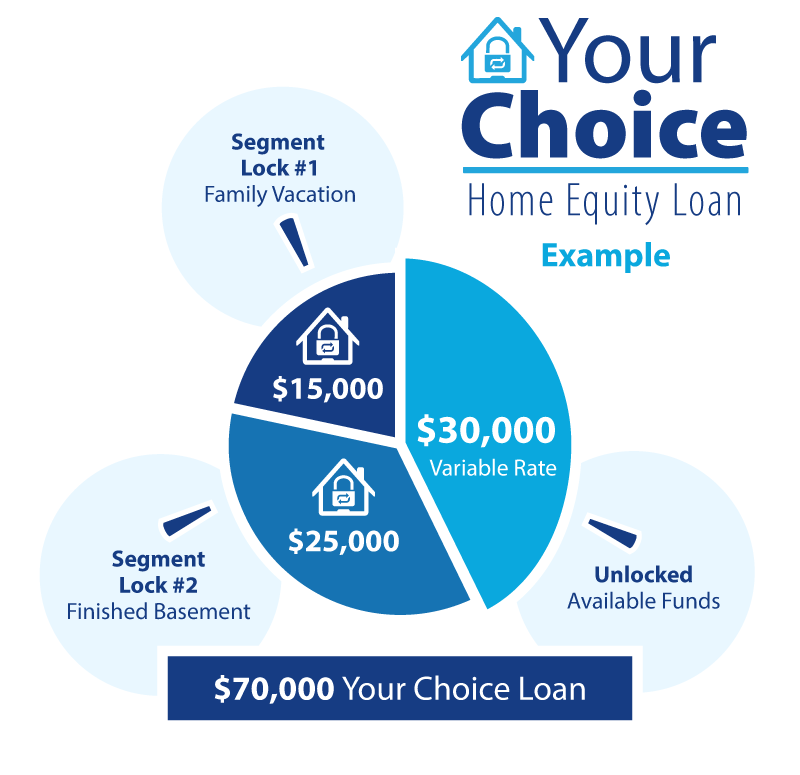

Usual home renovation jobs moneyed via equity financings include kitchen remodels, restroom renovations, basement completing, and landscape design upgrades. These jobs not just boost the top quality of life for homeowners however also add to boosting the curb appeal and resale worth of the building. In addition, purchasing high-quality products and modern design components can even more raise the aesthetic charm and functionality of the home. By leveraging equity for home enhancement jobs, home owners can develop areas that much better suit their requirements and choices while likewise making a sound economic investment in their home.

Emergency Costs

In unanticipated scenarios where instant monetary support is required, safeguarding an equity lending can supply home owners with a feasible solution for covering emergency situation costs. When visit this site right here unanticipated occasions such as medical emergency situations, urgent home repair services, or unexpected job loss occur, having accessibility to funds through an equity financing can use a safeguard for homeowners. Unlike other forms of loaning, equity fundings typically have reduced rate of interest and longer payment terms, making them an economical alternative for dealing with instant monetary requirements.

Among the essential benefits of utilizing an equity car loan for emergency situation expenditures is the rate at which funds can be accessed - Alpine Credits Home Equity Loans. Homeowners can promptly take advantage of the equity accumulated in their home, permitting them to deal with pushing monetary problems right away. In addition, the flexibility of equity fundings makes it possible for home owners to borrow just what they require, preventing the problem of tackling extreme financial debt

Education Financing

Amidst the quest of college, securing an equity loan can work as a strategic economic source for homeowners. Education and learning financing is a substantial worry for lots of families, and leveraging the equity in their homes can supply a way to gain access to required funds. Equity finances usually supply reduced rate of interest prices compared to other forms of financing, making them an eye-catching alternative for funding education expenses.

By touching right into the equity accumulated in their homes, house owners can access considerable amounts of money to cover tuition charges, books, holiday accommodation, and other relevant costs. Home Equity Loans. This can be specifically helpful for moms and dads seeking to support their children via university or individuals looking for to further their own education and learning. Furthermore, the rate of interest paid on equity loans may be tax-deductible, giving potential financial benefits for debtors

Eventually, using an equity financing for education and learning funding can aid individuals buy their future earning capacity and occupation improvement while successfully handling their financial responsibilities.

Financial Investment Opportunities

Conclusion

In verdict, homeowners select to safeguard an equity car loan for numerous reasons such as financial debt loan consolidation, home renovation jobs, emergency expenditures, education and learning financing, and financial investment chances. These loans offer a method for homeowners to accessibility funds for essential financial needs and goals. By leveraging the equity in their homes, home owners can make the most of lower rates of interest and flexible payment terms to accomplish their economic goals.

Report this page